![[Metroactive Features]](/features/gifs/feat468.gif)

[ Features Index | Santa Cruz Week | SantaCruz Home | Archives ]

Tapping Into the Death Star

How Carl Pechman and a team of Santa Cruz-based transcribers worked tirelessly to get the now-infamous Enron tapes into the public domain

By Sarah Phelan

If you've been keeping up with the still-unraveling Enron story, you probably know about a set of recently disclosed tapes on which traders such as "Bob" and "Kevin" above openly discussed bringing California to its knees during the so-called energy crisis of 2000-01, as they and their pals at Enron West were "scooping money into buckets" and gloating about their company's influence with then-presidential-hopeful George W. Bush.

"Burn, baby, burn," chants one trader as he cheers on the burning of a core transmission line in the West, while others openly discuss and engage in manipulative and fraudulent trading games, games whose names--Death Star, Wheel Out, Get Shorty, Fat Boy and Ricochet--speak volumes about the intent of these traders as they manipulated the energy market.

The release of the tapes shocked the nation with the Enron traders' crude language and naked greed, and delivered concrete proof that Enron's Western electricity traders had engaged in market manipulation to manufacture an energy crisis.

Which everyone, in this state at least, knew already. But what they don't know is that these revelations were first heard by a team of sleuths working with headphones glued to their ears in a windowless office atop Cruzio on Pacific Avenue in downtown Santa Cruz.

The Enron recordings were obtained in the fall of 2001 by the Snohomish Public Utility District in Washington state, as part of its legal defense against Enron, which is currently suing said utility for breach of contract. So how did it come to pass that a bunch of Cruzers ended up transcribing 2,800 hours of these tapes--a Sisyphean task that involved making sense of a bunch of foul-mouthed sexist traders speaking in energy trader jargon--for three months earlier this year?

Local Hero

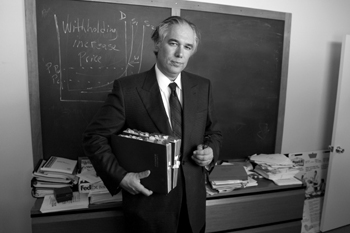

The answer lies with economist, Cornell graduate and local resident Dr. Carl Pechman, who founded energy consulting firm Power Economics in Santa Cruz after he relocated here from New York when his wife got a faculty position with UCSC seven years ago.

Pechman, who has been in the electric business for 30 years (first working on the economy of electricity as an undergrad, next as a regulator for the New York Public Service Commission and then as the author of Regulating Power: The Economics of Electricity in the Information Age in 1993), has dedicated his life's work to studying how electric systems work and are manipulated.

A witness for the public utility in Snohomish County--which is being sued for breaking a nine-year, high-priced contract with Enron, but says that contract should be voided because of Enron's fraudulent activities in the electricity meltdown--Pechman suddenly found himself in possession of a copy of the Enron tapes this February. He assembled a team in Santa Cruz to help decipher the thousands of hours of tapes, in the hope they contained evidence he could introduce in defense of the beleaguered Snohomish County utility.

In the end, thanks to the work of this team of Santa Cruz detectives, Pechman was able to introduce 10 hours of tapes with 82 exhibits into the Snohomish filing, thus putting a portion of the tapes' contents squarely in the public domain.

And even as lawyers for Enron told the networks that the tapes simply proved "that people at Enron sometimes talked like Barnacle Bill the sailor," Pechman was also able to state with legal authority that the recordings, as he says, "demonstrate an extremely callous abuse of consumers, large pattern of misconduct and reckless disregard of governmental authority by Enron."

"Not only were Enron's traders in Portland , Ore., well aware of Enron's games, but the recordings show that high level executives at Enron's Houston Headquarters--such as Ken Lay and Jeff Skilling--were kept appraised of Enron's gaming strategies and the profits reaped by the traders in Portland," Pechman stated in his prepared testimony on behalf of Snohomish County, also pointing to the harm Enron caused to economic efficiency outside California, since "the West operates as a single, integrated electric market."

Says Pechman of the task undertaken by his team of 12 to 14 listeners, "Much of it was hard tedious work. Only a very small portion of the transcripts ended up being made public, because lots of stuff didn't end up being on point. What we did find was evidence of gaming, market manipulation and withholding power--all of which was done within the structure of the corporation, not as part of some rogue operation. It was part of the company's business plan. The tapes speak for themselves with respect to politics."

Team Players

Bonny Doon resident and environmental consultant Lisa Bunin, who Pechman hired to pull together the team that decoded the tapes, credits "an incredibly talented and diverse staff, with a wide range of experience and expertise," for pulling off a clearly gargantuan task.

"That the job came to Santa Cruz was just the luck of the draw."

One might wonder what the team thought about going from traders gleefully cursing, ranting and singing on tape to hearing locals freely cursing, ranting and singing on Pacific Ave. But Bunin, who typically works from home as an environmental consultant, says she enjoyed her first-ever experience of working downtown as part of Pechman's team.

"It was a great opportunity to watch downtown wake up--and then go to sleep," says Bunin, who along with her fellow tape-listening colleagues frequently worked until 10 and 11pm--and pulled an all-nighter on the last day on the job to get Pechman his transcribed tapes on time.

Bunin recalls how at first everything on the tapes sounded suspect.

"One day, one of my colleagues said she was listening to Enron employees talking about going on a ski trip and it sounded suspicious. She wondered if talk of going to Costco to buy peanut bars, soda pop and bubble gum was code for something else," Bunin recalls.

She praises Pechman's ability to explain complicated ideas about electricity in a way that's easy to understand.

"Usually we had a lot of acronyms related to the energy trade on any one day, for which Carl would give us an explanation," says Bunin. "That coupled with people's own frame of reference--someone would say, 'My electricity bill tripled, now I have a better understanding of how that happened'--and the fact that team members created a wall of shame on which they stuck articles about Enron, helped us all better understand the machinations of the energy market."

Paid what she calls "a good wage for Santa Cruz," Bunin admits that the money would doubtless seem like peanuts to Enron energy traders, some of whose retention bonuses (bonuses Enron is paying to keep people on board even as the company goes bankrupt) are in the $2.6 million range.

"But every morning it was a joy to wake up and come to this job," she says, "because there wasn't any grandstanding. It was about working together and trying to find evidence of bad energy trading practices."

Sacramento Connection

Pechman's desire to bring Enron to justice dates back to his sensing early on in the 2000-01 energy meltdown that the crisis had nothing to do with shortage in supply and demand, and everything to do with gaming the market. At which point, he picked up the phone and offered his services to then-state Assemblymember Fred Keeley, who had been tasked with the job of working out what was causing the crisis and how best to handle it--a task that once again was complicated by the fact that the energy industry's jargon is largely incomprehensible to anyone except those working within it.

As Keeley recalls, Pechman's call came at the time that he and the rest of the Legislature were only getting 3 to 5 hours a sleep a night, seven days a week, as they pulled all-nighters in Sacramento.

"We were getting hundreds and thousands of phone calls and emails a day, ranging from 'You should all be strung up for allowing this to happen" to 'I've got the perpetual motion machine to solve California's energy problems forever.' So, we set up a triage system to separate the real bananas from the wax ones, and Carl got through that filter because he was a serious, thoughtful guy with a substantial depth of knowledge."

Keeley's first take on Pechman proved to be 100 percent right on. "Whether it was conversations with merchant investors, traders, the FERC [Federal Energy Regulatory Commission] or whoever, Carl could stay with them. There wasn't a reference, chart or theory around to which he couldn't say, 'Wait a minute! That's not right.' And then there's the fact that he's too much,' says Keeley, recalling with bemused wonder how Pechman would appear in the Sacramento office, after crawling all over energy contracts, documents and legislation for 18 hours straight, his hair messed up, his glasses down on his nose, with a grin on his face.

"He'd shuffle his feet, he could hardly wait, and he'd smile, and then he'd go off about something and say, 'Isn't that great?' and we'd just laugh and say, 'Maybe, but what does it mean?' and Carl would try to break it down by giving more details--and we'd have to remind him that he was dealing with elected officials and their staff."

Information Overload

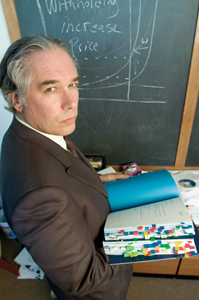

Pechman has been a material witness in just about every related court case since the 2000-01 energy crisis went down. And he has some ideas about how the whole thing could have been avoided, starting with a completely different design for California's energy market.

"A little less faith that just because we say a market is competitive meant it actually is competitive would have been helpful," he says.

He traces the start of the so-called energy crisis back to 1994, when the state agreed to the separation of functions within the power system.

"My position is that this separation was what facilitated Enron's ability to control the market," says Pechman, who says he prefers a mixed competitive and regulated market model. "One of the problems of electrical systems is that by the nature of their history, they were not designed to be competitive, meaning we tried to impose a competitive market onto a physical structure that may not be suited to competition."

Acknowledging that "competition is good," Pechman says there are real benefits to be derived from the old utility market structure, namely the elimination of risk, "which reduces the cost of capital to the utilities, meaning they are able to pass energy onto customers at lower rates, as opposed to the market-oriented model of Enron."

For him, one of the real tragedies to occur as a result of the contemporary competition obsession has been the abandonment of state regulatory commissions, not only in California but also in New York.

'Those commissions don't have new people coming in, they don't have enough training, their staff numbers have dropped and all of them are getting older," he says.

Beyond Obscene

By contrast, the Enron tapes paint a picture of the traders that "suggests a young brash crowd lacking in customer-oriented values," he says.

Which explains why what bothered Pechman most about the tapes--"as an older utility person who shares the ethos from the era of "providing service," as he puts it--was not the obscenities, but the glee that the traders expressed at creating unreliability in service.

"That was so antithetical to all of the values of the electric industry, and that's what I found upsetting more than the generally abusive nature of these people," he says. "They turned our whole value system upside down. When I presented testimony for the legislature, I said to the FERC, 'This kind of behavior is going to have a detrimental effect.'"

As for future "crisis protection," Pechman believes that mechanisms need to be put in place to create financial stability and limit the overall volatility of the generators' profits.

"Some form of more innovative regulation is perhaps warranted than what we've so far had," he says.

He also remains hopeful that justice will be served.

"California needs to make sure the representatives of the people of California represent the interests of the customers in California and insist that the FERC protect the customers," he says. "One of the lessons we learned is that the regulatory process did not and has not yet protected the customers. The regulatory process is charged with protecting customers, so if any new legislation is passed, it's important to make sure it keeps that purpose."

Bringing Out the Best

One of the other lessons learned from the crisis was just how successful customers were in reducing actual demand for power.

"During the crisis, we saw a 12-15 percent reduction," he recalls. "Once Stage 3 was announced, you could literally watch the meter dropping. People responded to the emergency in amazing ways. From January to June 2001, we were overcharged $7 billion, so a 15 percent savings, presuming prices stayed the same, had to have been over 1 billion dollars, easily."

Asked about Bush's statement, mid-energy crisis, that he wouldn't install price caps, Pechman says, "The FERC thinks the way to protect customers is by enriching the generators. The idea is that to have a reliable system, the generators need to have lots of money. And Bush's logic is based upon the notion that a competitive market is the most efficient. What the FERC failed to recognize, both in its refunds design and remedies during the crisis, is that the market is not competitive."

So, just when will California customers see their money back?

'I don't know if they're gonna get their money back," Pechman says. What's amazing is how much money has been squandered. Many of the gamers and manipulators have had substantial financial difficulties. There was a huge wealth transfer, mostly from California to Texas, but at the end of the day, you look at the players and say, 'So, who really got wealthy?'"

For now, Pechman--who describes himself as a problem solver, not a troublemaker--says he's very happy that the work of unraveling the tapes was done in Santa Cruz--and continues to go on to this day.

"We had a wonderful group of talented dedicated people," he says, "and the work isn't over yet. The trial lies ahead."

With the Snohomish utility district trial set for October 2004, readers can read Pechman's testimony, court motions and the audio transcripts at www.enrontapes.com.

Copyright © Metro Publishing Inc. Maintained by Boulevards New Media.

For more information about Santa Cruz, visit santacruz.com.

![]()

Grid Luck: Carl Pechman founded the energy consulting firm Power Economics in Santa Cruz seven years ago, and ended up handling the now-infamous Enron tapes when he was asked to appear as a witness in a case involving the company.

Photos by Stephen Laufer

Kevin: So the rumor's true? They're fuckin' takin' all the money back from you guys? All that money you guys stole from those poor grandmothers in California?

Bob: Yeah, Grandma Millie, man, but she's the one who couldn't figure out how to fuckin' vote on the butterfly ballot.

Kevin: Yeah, now she wants her fuckin' money back for all the power you've charged right up--jammed right up her ass for fuckin' 250 dollars a megawatt hour.

[laughter]

Bob: You know, Grandma Millie, she's the one Al Gore's fighting for, you know?

--Excerpt from Enron trader tapes

Power to the People: In the end, Pechman was able to introduce 10 hours of tapes with 82 exhibits on behalf of an embattled Washington state public utility, which put a portion of the tapes' contents squarely in the public domain.

No Rest for the Learned: Pechman's expertise has led to him being called as a material witness in just about every related court case since the 2000-01 energy crisis went down.

From the July 7-14, 2004 issue of Metro Santa Cruz.